Forms

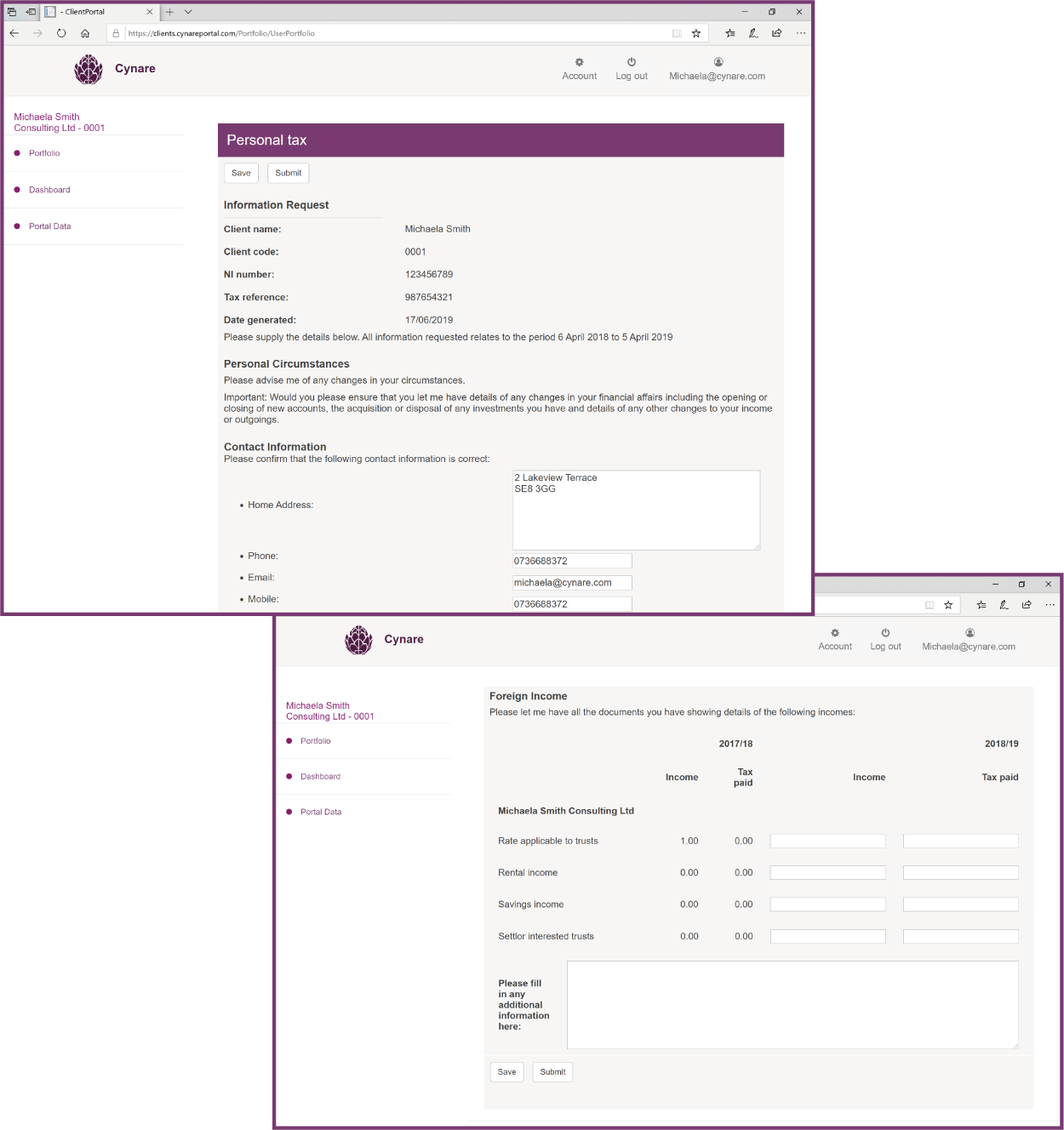

The Client portals enable a firm to present its Clients with a variety of forms

The forms may take information from a variety of internal production and compliance systems, presenting it to the Client in a simple form for them to action

Such forms could be used for the following

- Updating mailing preferences

- Updating annual tax questionnaires

- Client take on and anti-money-laundering

The automation notifies the relevant person in the firm if the Client fails to complete the form or becomes stuck

Features

The form is completely flexible to suit the requirements of the firm and the User

As the system is highly automated it reduces the firm’s risk and costs associated with manual processes

With Cynare Forms, the Client completes the form online

If any queries arise, the Client may raise them in the Cynare Client Portal’s secure messaging system

If the Client fails to complete the form for any reason, the system can send alerts to the team member dealing with that Client in order to prompt a follow-up

As every Client’s affairs are unique, the same Cynare Form supplies a unique form to each Client, based upon the information held on them in the tax compliance system

Technology

A Cynare Form is an XML web page returning information from a database

Traditional databases supporting software used by the majority of Accounting firms in the UK are connected using the Cynare Link system

Modern software systems including Government sites, such as HMRC and Companies House, are linked using their APIs (application programming interface)